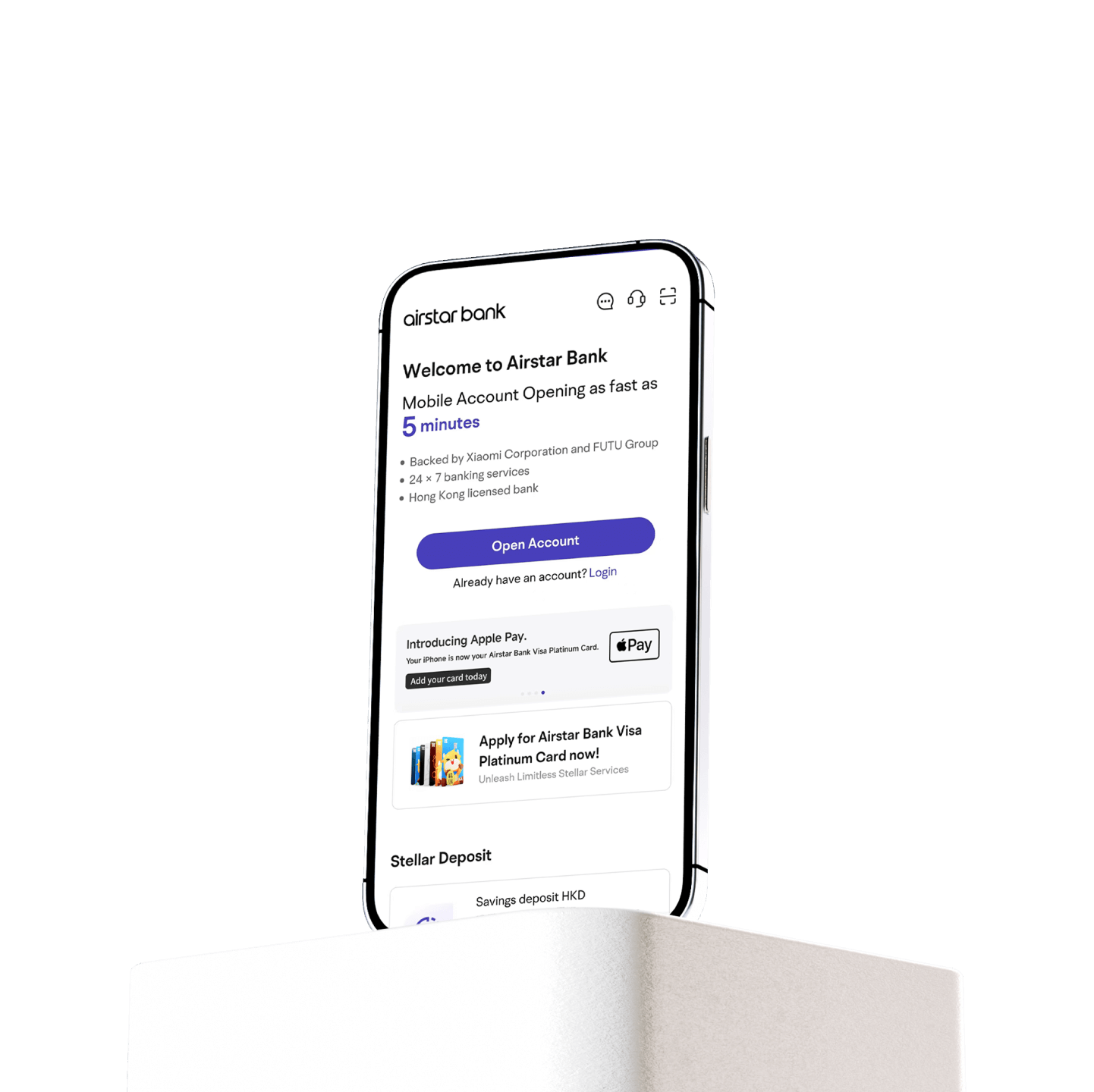

![]() Personalized Stellar APR2

Personalized Stellar APR2

![]() Total loan amount up to 12 times of monthly salary3

Total loan amount up to 12 times of monthly salary3

![]() From application to loan disbursement, complete in as fast as 5 minutes4

From application to loan disbursement, complete in as fast as 5 minutes4